Climate Tech

If Natron Couldn’t Make Batteries in the U.S., Can Anyone?

The failure of the once-promising sodium-ion manufacturer caused a chill among industry observers. But its problems may have been more its own.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

The failure of the once-promising sodium-ion manufacturer caused a chill among industry observers. But its problems may have been more its own.

At Heatmap House’s third session of the day, “Up Next in Climate Tech,” investors Tom Steyer and Dawn Lippert chart a path forward for the clean energy economy.

Rob and Jesse talk to Ember’s Kingsmill Bond about how electricity is reshaping global geopolitics.

Xerion is using molten salt to refine the key battery mineral domestically and efficiently.

Elemental Impact, Breakthrough Energy, Speed & Scale, Stanford, Energy Innovation, and McKinsey are all partnering to form the “Climate Tech Atlas.”

Zanskar’s second geothermal discovery is its first on untapped ground.

For the past five years or so, talk of geothermal energy has largely centered on “next-generation” or “enhanced” technologies, which make it possible to develop geothermal systems in areas without naturally occurring hot water reservoirs. But one geothermal exploration and development company, Zanskar, is betting that the scope and potential of conventional geothermal resources has been vastly underestimated — and that artificial intelligence holds the key to unlocking it.

Last year, Zanskar acquired an underperforming geothermal power plant in New Mexico. By combining exclusive data on the subsurface of the region with AI-driven analysis, the company identified a promising new drilling site, striking what has now become the most productive pumped geothermal well in the U.S. Today, the company is announcing its second reservoir discovery, this one at an undeveloped site in northern Nevada, which Zanskar is preparing to turn into a full-scale, 20-megawatt power plant by 2028.

“This is probably one of the biggest confirmed resources in geothermal in the last 10 years,” Zanskar’s cofounder and CEO Carl Hoiland told me. When we first connected back in August, he explained that since founding the company in 2019, he’s become increasingly convinced that conventional geothermal — which taps into naturally occurring reservoirs of hot water and steam — will be the linchpin of the industry’s growth. “We think the estimates of conventional potential that are now decades old just all need to be rewritten,” Hoiland told me. “This is a much larger opportunity than has been previously appreciated.”

The past decade has seen a lull in geothermal development in the U.S. as developers have found exploration costs prohibitively high, especially as solar and wind fall drastically in price. Most new projects have involved either the expansion of existing facilities or tapping areas with established resources, spurring geothermal startups such as Fervo Energy and Sage Geosystems to use next-generation technologies to unlock new areas for development.

But Hoiland told me that in many cases, conventional geothermal plants will prove to be the simplest, most cost-effective path to growth.

Zanskar’s new site, dubbed Pumpernickel, has long drawn interest from potential geothermal developers given that it’s home to a cluster of hot springs. But while both oil and gas companies and the federal government have drilled exploratory wells here intermittently since the 1970s, none hit hot enough temperatures for the reservoirs to be deemed commercially viable.

But Zanksar’s AI models — trained on everything from decades old geological and geophysical data sets to newer satellite and remote sensing databases — indicated that Pumpernickel did indeed have adequately hot reservoirs, and showed where to drill for them. “We were able to take the prior data that was seen to be a failure, plug it into these models, and get not just the surface locations that we should drill from, but [the models] even helped us identify what angle and which direction to drill the well,” Hoiland told me.

That’s wildly different from the way geothermal exploration typically works, he explained. Traditionally, a geologist would arrive onsite with their own mental model of the subsurface and tell the team where to drill. “But there are millions of possible models, and there’s no way humans can model all of those fully and quantitatively,” Hoiland told me, hence the industry’s low success rate for exploratory wells. Zanskar can, though. By modeling all possible locations for geothermal reservoirs, the startup’s tools “create a probability distribution that allows you to make decisions with more confidence.”

To build these tools, Hoiland and his cofounder, Joel Edwards, both of whom have backgrounds in geology, tracked down and acquired long forgotten analog data sets mapping the subsurface of regions that were never developed. They digitized these records and fed them into their AI model, which is also trained on fresh inputs from Zanksar’s own data collection team, a group the company launched three years ago. After adding all this information, the team realized that test wells had been drilled in only about 5% of the “geothermally prospective areas of the western U.S.,” leaving the startup with no shortage of additional sites to explore.

“It’s been nine years since a greenfield geothermal plant has been built in the U.S.,” Edwards told me, meaning one constructed on land with no prior geothermal development. “So the intent here is to restart that flywheel of developing greenfield geothermal again.” And while Zanskar would not confirm, Axios reported earlier this month that the company is now seeking to raise a $100 million Series C round to help accomplish this goal.

In the future, Zanskar plans to test and develop sites where exploratory drilling has never even taken place, something the industry essentially stopped attempting decades ago. But these hitherto unknown sites, Edwards said, is where he anticipates “most of the gigawatts” are going to come from in the future.

Hoiland credits all this to advances in AI, which he believes will allow geothermal “to become the cheapest form of energy on the planet,” he told me. Because “if you knew exactly where to drill today, it already would be.”

On Toyota’s recalls, America’s per-capita emissions, and Sierra Club drama

Current conditions: Drought is worsening in the U.S. Northeast, where cities such as Pittsburgh and Bangor, Maine have recorded 30% less rainfall than average • Temperatures in the Mississippi Valley are soaring into the triple digits, with cities such as Omaha, Nebraska and St. Louis breaking daily temperature records with highs of up to 20 degrees Fahrenheit above average • A heat wave in Mecca, Saudi Arabia, has sent temperatures as high as 114 degrees.

Orsted is offering investors a nearly 70% discount on the new shares issued to raise money to save its American offshore wind projects amid the Trump administration’s aggressive crackdown on the industry. The Danish energy giant won nearly unanimous approval from its shareholders earlier this month for a rights issue aimed at raising $9.4 billion. Shares in the company, which is half owned by the government in Copenhagen, closed around $32 each on Friday. But the offering of 901 million new shares came at a subscription rate of about $10.50 each. Orsted’s projects in the northeastern U.S. already “struggled” with what The Wall Street Journal listed as “supply-chain bottlenecks, higher interest rates, and trouble getting tax credits,” which culminated in the restructuring last year that saw the company “pull out of two high-profile wind projects off the coast of New Jersey.”

The offshore wind industry, as I noted in yesterday’s newsletter, is just starting to fight back. The owners of the Rhode Island offshore project Revolution Wind, which Trump halted unilaterally, filed a lawsuit claiming the administration illegally withdrew its already-finalized permits. After the administration filed a lawsuit to revoke the permits of US Wind’s big project off Maryland’s coast, the company said it intends “to vigorously defend those permits in federal court, and we are confident that the court will uphold their validity and prevent any adverse action against them.” But the multi-agency assault on offshore turbine projects has only escalated in recent months, as the timeline Heatmap’s Emily Pontecorvo produced shows. And Orsted is facing other headwinds. The company just warned investors of lower profits this year after weaker-than-forecast wind speeds reduced the output of its turbines.

Toyota issued a voluntary recall for some 591,000 Toyota and Lexus cars over a slight glitch in the display screen. The 12.3-inch screen could fail to turn on after the car started, or go black while driving. Toyota said it will begin notifying owners if affected vehicles by mid-November. The move came just days after the Japanese auto giant — which owns both its eponymous passenger car brand and the associated luxury line, Lexus — recalled 62,000 electric vehicles, including the Toyota bZ4X SUV and the Lexus RZ300e sedan and its luxury SUV, the RZ450. Subaru, in which Toyota owns a minority stake, is also recalling its electric SUV, the Solterra. With all four EVs, the issue revolved around a faulty windshield defroster that “may not remove frost, ice and/or fog from the windshield glass due to a software issue in the electrical control unit,” the company said in a press release..

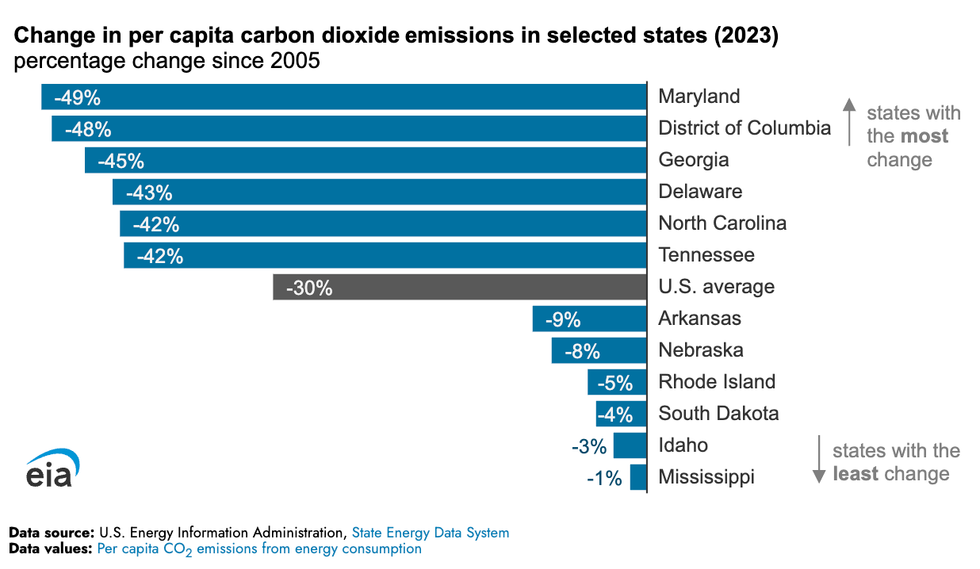

Americans who complain that the U.S. should bear less responsibility for mitigating climate change like to point out that China produces far more planet-heating emissions per year, and that India is not far behind. The cumulative nature of carbon in the atmosphere makes for an easy rebuke, since the U.S. and Western Europe are overwhelmingly responsible for the emissions of the past two centuries. But a less historically abstract response could be that Americans still have by far the highest per capita emissions of any large country. That doesn’t mean the U.S. isn’t making progress on a per capita level, though. Between 2005 and 2023, per capita emissions from primary energy consumption decreased in every U.S. state, with an average drop of 30%, even as the American population grew by 14%, according to a new analysis by the U.S. Energy Information Administration. The dip is largely thanks to the electric power sector burning less coal. Increased electricity generation from natural gas, which releases about half as much carbon per unit of energy when burned as coal, and the growth of renewables such as wind and solar have reduced the need for the dirtier fuel. But the EIA forecasts that overall U.S. emissions are set to climb by 1% as electricity demand increases.

For those keen to shrink their individual carbon output at a much faster pace than American society at large, Heatmap’s award-winning Decarbonize Your Life series walks through the benefits and drawbacks to driving less, eating less steak, installing solar panels, and renovating homes to be more energy efficient.

Following rebellions from various state chapters, the Sierra Club terminated its executive director, Ben Jealous, last month, as I reported here in this newsletter at the time. Now the group has named its new leader: Loren Blackford. The Sierra Club veteran, who served in various senior roles before taking on the interim executive director job last month, won unanimous support from the group’s board of directors on Saturday.

Jealous had previously served as a chief executive of the National Association for the Advancement of Colored People and the 2018 Democratic nominee for Maryland governor before becoming the first non-white leader of the 133-year-old Sierra Club. His appointment marked a symbolic turning of the page from the group’s early chapters under its founder, John Muir, who made numerous derogatory remarks about Black and Native Americans. Jealous was accused of sexual harassment earlier this year.

Thermal battery company Fourth Power just announced $20 million in follow-on funding, building on its $19 million Series A round from 2023. While other thermal storage companies such as Rondo and Antora are targeting the decarbonization of high-temperature industrial processes such as smelting or chemical manufacturing, Fourth Power aims to manufacture long-duration energy storage systems for utilities and power producers.

“In our view, electricity is the biggest problem that needs to be solved,” Fourth Power’s CEO Arvin Ganesan told Heatmap’s Katie Brigham. “There is certainly a future application for heat, but we don’t think that’s where to start.” The company’s tech works by taking in excess renewable electricity from the grid, which is used to heat up liquid tin to 2,400 degrees Celsius, nearly half the temperature of the sun’s surface. That heat is then stored in carbon blocks and later converted back into electricity using thermophotovoltaic cells. This latest funding will accelerate the deployment of the startup’s first one megawatt hour demonstration plant.

The tropical storm that later became Hurricane María formed exactly eight years ago today and went on to lay waste to Puerto Rico’s aging electrical system. The grid remains fragile and expensive, with frequent outages and some of the highest rates in the U.S. on the hours when the power is accessible. That has spurred a boom in rooftop solar panels. Now more than 10% of the island’s electricity consumption comes from rooftop solar power. Data released by the grid operator LUMA Energy showed approximately 1.2 gigawatts of residential and commercial rooftop solar had been installed under Puerto Rico’s net-metering regulations as of June 2025. New analysis by the Institute for Energy Economics and Financial Analysis found that is equal to about 10.3% of Puerto Rico’s total power consumption — and that’s not counting any off-grid systems.